Robotic Vacuum Cleaner Market Size, Share & Trends Analysis Report

Report Overview

The global robotic vacuum cleaner market size was valued at USD 2.56 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2020 to 2027. Decreased time for household activities is one of the key factors driving demand for robotic vacuum cleaner. Changing lifestyle, high disposable income, growing working population, rising purchasing power, and ease of usage are the major factors acting as a catalyst for the growth of the market worldwide. Consumers in the market are more inclined towards the purchase of robotic vacuum cleaners owing to their ability to clean the area without human intervention. Consumers don’t need to worry about battery recharging as these robots are capable of automatically maneuvering themselves towards the charging point and restarting from the same point at which it got discharged. Consumers can set virtual boundaries for the robot and can restrict entry in areas, such as children's playroom.

Less time availability for household chores is acting as a major factor driving the adoption among consumers. Growing disposable income among dual-income households is acting as a major factor supporting the market growth. Higher penetration and adoption rate of robotic vacuum cleaners is creating opportunities for manufacturers in the market. Companies are introducing new products in order to gain a greater market share. For instance, in December 2018, Neato Robotics announced the launch of Neato Zone Cleaning for the Botvac D7 Connected and No-Go Lines feature for Botvac D3 Connected. With the help of the zone cleaning feature, consumers can highlight the portion or a dedicated area for active cleaning. Whereas, with the help of the No-Go line, consumers can create no go zone. This innovation is offering flexibility to users for effective use of robotic vacuum cleaner.

The growing trend of smart home is acting as a major supporting factor for market growth. Considering this factor, in September 2019, iRobot updated theAmazon Alexa & IFTTT functionality inWi-Fi enabled Roomba robots in India and other developing countries. Consumers can start, stop, and pause the help of voice activation command.

Rise in technological integration is further estimated to support market growth. However, the high cost of the products is acting as a major challenge for the market. It is restricting the adoption of product among mass users. Availability of various counterfeit products in the market is acting as a major restraint for the market.

Report Coverage & Deliverables

Competitive benchmarking

Historical data & forecasts

Company revenue shares

Regional opportunities

Latest trends & dynamics

Type Insights

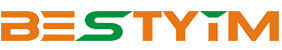

In terms of revenue, the floor vacuum cleaner type dominated the market with a share of 82.4% in 2019 and is expected to witness the fastest growth over the forecast period. Consumers in the market are more inclined towards the purchase of floor vacuum cleaner owing to its ability to be used on various surfaces, such as wooden floor, marble, vinyl, and tiles flooring. Most of the daily routine of household cleaning focuses on cleaning floors, and hence the demand for floor vacuum cleaners is on the rise.

Moreover, rise in the introduction of products with advanced features and technologies is acting as a major factor boosting the growth of the segment. For instance, in September 2019, Ecovacs Robotics announced the launch of DEEBOT 661 and DEEBOT 711S and they can be purchased from online retailer Amazon.com. DEEBOT 661 is a convertible floor cleaning robot and can go from vacuum to mop, depending on consumer’s needs.

The pool vacuum cleaner category is expected to expand at a CAGR of 16.0% from 2020 to 2027. Consumers in the market are more inclined towards the purchase of pool vacuum cleaners in order to remove rough debris with the brushing system, which also helps in removing bacteria and algae from pool surfaces, including floors and walls. Moreover, consumers save expenditure on electricity, water, and chemicals. As per Maytronics, there are around 25.5 million pools worldwide and around 19 million pools are cleaned without robots. This is creating significant growth opportunities for the market.

Distribution Channel Insights

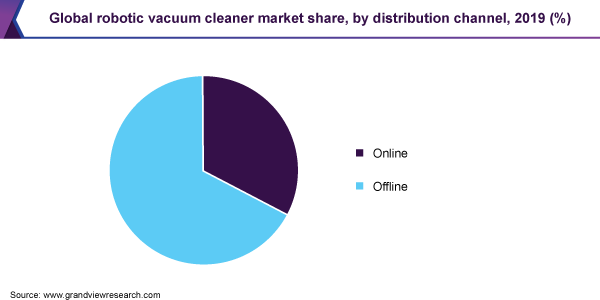

In terms of revenue, offline distribution channels dominated the market with a share of 67.3% in 2019. This is attributed to the rising number of electronics and appliance specialty stores, resulting in increasing shelf space for the marketing of products. Consumers tend to purchase robotic vacuum cleaners from offline stores to find the right fit and understand the mechanism and functionality of the robotic vacuum cleaner. Moreover, many retailers in the market have sales representatives in order to offer the right product as per consumers’ need and consumers can get the demo of the products’ working pattern.

The online distribution channel segment is expected to expand at the fastest CAGR of 19.1% from 2020 to 2027. Increase in social media marketing is supporting the growth of the online distribution channels. The availability of various products with comparison features on the website and easy return policy are shifting consumers’ inclination towards online purchase. Moreover, consumers prefer purchasing from online platforms to get discounts. Multi-brand online retailers are preferred by time-bound consumers to select robotic vacuum cleaner from several providers. Rising direct-to-consumers offering is also acting as a catalyst for the growth of the online segment.

Regional Insights

Asia Pacific dominated the market for robotic vacuum cleaner with a share of 36.2% in 2019 and is expected to witness the fastest growth over the forecast period. In Asia Pacific, China is a key contributor and the country generated the maximum revenue in 2019. This is attributed to the low cost of the product, the high purchasing power of consumers, and the strong presence of regional companies in the country. In 2019, Ecovacs Robotics had witnessed a sales jump of 12% year-on-year globally on Double 11, also called Singles Day. The company generated a revenue of USD 14.5 million in 10 minutes, USD 43.5 million in 87 minutes, and USD 72.5 million in 17 hours and 31 minutes. Outside of mainland China, the company noticed a growth of 80% compared to 2018, in five countries, three platforms, and on 11 online channels. In Singapore, sales jumped over 150% compared to Double 11 in 2018. These aforementioned factors are boosting the market growth in the region.

Europe emerged as the second-largest regional market in 2019. This is attributed to innovation in the product offerings in the region, along with consumers’ willingness to spend on added value and innovative products simplifying life. In May 2019, iRobot Corp. launched two new robots Roomba s9+ robot vacuum that features PerfectEdge Technology with wider brushes, superior suction, and an advanced 3D sensor and Braava jet m6 robot mop that tackles messes throughout the entire home. These robots can be integrated with each other via Imprint Link Technology to work together. Consumers can co-ordinate the robots via iRobot app to clean the home without any intervention. The products were available in the European market from July 2019.

Key Companies & Market Share Insights

The market is highly competitive. Companies are focusing on expanding their product lines and are adopting innovative technologies owing to meet consumer demand for robotic vacuum cleaners. Companies in the market are shifting their manufacturing facilities to Asian countries in order to lower the price of the products and hold a strong supply chain in the fastest-growing region. For instance, in November 2019, iRobot Corp., along with Jabil, Inc., a manufacturing and supply chain partner of the company in China since 2010, has expanded its manufacturing footprint in Malaysia. The company is producing Roomba 600 Series model in Malaysia and is estimated to boost production in the first quarter of 2020. The aforementioned factors are estimated to increase the competition in the market over the forecast period Some of the prominent players in the global robotic vacuum cleaner market include:

iRobot Corporation

Ecovacs Robotics

Xiaomi Corporation

Beijing Roborock Technology Co., Ltd.

SharkNinja Operating LLC

Neato Robotics, Inc.

Cecotec Innovaciones S.L.

Panasonic Corporation

Samsung Electronics Co., Ltd.

Dyson Ltd.